Innovative Solutions. Proven Expertise.

REAL ESTATE MERCHANT BANKING

Innovative Solutions. Proven Expertise.

REAL ESTATE MERCHANT BANKING

As 2016 comes to a close, we find ourselves at a precipice of two significant events in the RE sector to bear in mind for 2017.

Over the past 5 years, there has been a lot of discussion and preparation for the wave of 2007 vintage CMBS loan maturities and the looming opportunities it presents. More recently, as the result of the nomination of President Elect Trump, we are seeing a changing political and regulatory climate. Recent insights into his administration’s proposed policy seem to be focused on bank deregulation, as well as, divestment from government sponsored agencies; Fannie Mae and Freddie Mac. The confluence of these two significant events present an opportunity to make 2017 a banner year for real estate transactions.

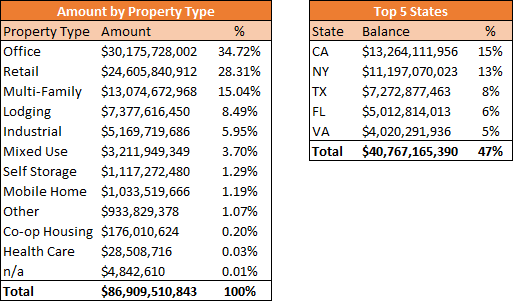

At the beginning of 2015 there was roughly $230 billion of CMBS loans set to mature by 2017, raising concern in the capital markets as to how these loan maturities would be absorbed and handled come 2017. According to CREFC, out of the estimated $230 billion originated in 2007, there is approximately $87 billion scheduled to mature next year. This figure is far more manageable and much lower than anticipated a year ago.

Of the $90 billion, the retail and office sectors make up the largest volume of loans coming due, approximately $30 billion and $24.6 billion respectively, along with high LTVs (over 80%). These high LTV loan maturities, originated during an era of looser underwriting standards, will present an opportunity for investors and mezzanine lenders alike as conventional financing using todays underwriting standards will not be sufficient to refinance the outstanding loan balances in their entirety.

Conversely, this may also result in increased delinquencies in CMBS loans, foreclosures, and eventual REO sales which will take time to resolve and bleed into 2018 and 2019.

With the risk retention regulations coming into play with respect to CMBS, we expect CMBS loan origination to be further constrained in 2017 unless there are changes to the regulatory framework. While the regulations, which require lenders to retain a stake in loans originated, will ultimately help overall CMBS loan quality, the cost of doing so will ultimately be passed onto the borrowers. This may result in CMBS becoming less competitive and alternative sources of financing stepping in.

The President Elect’s new treasury secretary, Steve Mnuchin has been vocal recently about de-regulating the banks and exiting out of the ownership of Fannie Mae and Freddie Mac. While we have not been privy to the details of the new administration’s plans there has been some discussion that Dodd-frank (the framework governing risk retention laws, the Volker Rule, and reserve requirements) will be revisited.

Loosening of banking regulation resulting in increased liquidity from banks would be positive for the real estate sector. There are many unanswered questions as to the process and how the administration will handle exiting ownership from government sponsors agencies, Fannie and Freddie. These agencies have been the backbone to cheap capital which has helped sustain the high transactional activity in the multifamily sector. If the spin-off of Fannie and Freddie reduces to the availability of capital and increases pricing, there will be significant implication to pricing of MF properties.

As we approach 2017, the confluence of these two events have the potential to make 2017 a banner year in terms of transaction volumes for the real estate industry.

♦

If you have a pending transaction in need of financing, contact a member of the Dekel Capital executive team to discuss how we can assist in getting your project over this hurdle and finding the best capital source for your needs.